More Information

Submitted: April 08, 2022 | Approved: May 12, 2022 | Published: May 16, 2022

How to cite this article: Ray PK. A study on cyber financial frauds in the district of Jamtara, Jharkhand. J Forensic Sci Res. 2022; 6: 042-044.

DOI: 10.29328/journal.jfsr.1001034

Copyright License: © 2022 Ray PK. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

A study on cyber financial frauds in the district of Jamtara, Jharkhand

Pranav Kumar Ray*

Department of Forensic Science, Jharkhand Raksha Shakti University, Ranchi, India

*Address for Correspondence: Pranav Kumar Ray, MSc., Forensic Science, JRSU, Certified Data Examiner, Guest Speaker at Jharkhand Police Academy, Forensic Investigator at Ranchi District Police, Laboratory In-Charge, Department of Forensic Science, Jharkhand Raksha Shakti University, Ranchi, Jharkhand, India, Email: [email protected]

The study has been undertaken to investigate the determination of digital financial fraud (cyber fraud) in Jamtara district of Jharkhand (the hub of cyber fraudsters) the basic tools & techniques which are used by the offenders and to find out the socio-economic condition of their social life & find the new challenging in cybercrime investigation and to find out the more secure way of digital financial flow, by using survey research method and work on secondary as well primary data which was related to this study, cybercrime especially financial fraud becomes the new challenging task for law enforcement agencies.

Digital financial frauds are being within an undefined jurisdiction so it becomes more difficult to investigate the cases and due to other different public as well private sectors of service providers like the telecom companies and the banks are unable to make the defensive system for their customer also. This is the main reason for delays in cyber-related case investigation and a very low conviction rate in cyber-related cases.

The coming era will dependable upon digital finance for everything the people uses the digital platform because the current era of the world is an era of technological (digitalization) and in today’s digital world most of the work being done through digital platform hence, giving people easy access to everything while sitting in one place. So the financial work including financial transactions, financial investments, and many other finance-related works is done in the electronic medium and transacted through cyberspace. Nowadays everyone gives preference to the digital system over the traditional system. But along with the benefits, it has also brought up a new orientation to the risk and even new forms of risks the negative side of the cyber world is both inevitable and unavoidable in the financial sector.

All around the world according to The Global fraud and identity report (2018-19, more in 2020-21) (Experian) most consumers own smartphones and mobile devices (91%), and technology is supporting the large volume of online interactions between businesses and Online activities among consumers reflect the widespread embrace of digital commerce as a way to purchase goods and service (90%) and conduct personal banking (88%), we know that our country is one of the fast-growing countries in the world and the citizen of our country adopt this digital system very rampantly. At the same time, there is a rampant jump in the number of digital financial frauds and the value, making it a major concern to the people in India and elsewhere. Each day fraudsters enact new methods to execute their frauds practices. Financial frauds can impact the individual with direct financial loss leading to emotional & psychological stress.

The digital financial frauds (cyber economic crime) which shown rapid growth in the past few years are ATM card cloning, vising (voice phishing), phishing, and SIM swapping. Most of them are low-tech crimes. Nowadays Jharkhand’s Jamtara become a hotbed of low-tech financial frauds, According to the govt. Expert, more than half of the cyber-crimes are being committed by fraudsters from Jharkhand (Jamtara). And when I talk about the current trends of cyber-crime the cases of card cloning are very high. In this Research work, I mainly focus on India’s cyber-crime hub Jamtara. Digital finance encompasses a magnitude of new financial products, financial businesses, finance-related software, and novel forms of customer communication and interaction delivered by Fin-Tech companies and innovative financial service providers. There is no standard definition of digital finance; there is some consensus that digital finance encompasses all products, services, technology, and/or infrastructure that enable individuals and companies to have access to payments, savings, and credit facilities via the internet (online) without the need to visit a bank branch or without dealing directly with the financial service provider.

The recent improvement in the accessibility and affordability of digital financial services around the world can help millions of poor customers move from cash-based transactions to formal digital financial transactions on secured digital platforms (CGAP). Digital finance promises to boost the gross domestic product (GDP) of digitalized economies by providing convenient access to a diverse range of financial products and services (and credit facilities) for individuals as well as small, medium, and large businesses, which can boost aggregate expenditure thereby improving GDP levels. Digital finance can also lead to greater economic stability and increased financial intermediation, both for customers and the economy. Digital finance also benefits governments by providing a platform to facilitate an increase in aggregate expenditure which subsequently generates higher tax revenue arising from the increase in the volume of financial transactions. Digital finance has benefited financial and monetary system regulators because full-scale digital finance adoption can significantly reduce the circulation of bad (or fake) money, etc.

Online transaction

People have started opting for social media and mobile apps for most banking transactions. There are three different ways like RTGS, NEFT, and IMPS through which we can transfer funds from one bank account to another.

NEFT: It is an electronic fund transfer system that operates on a DNS (Deferred Net Settlement) basis which settles transactions in batches. You can use the NEFT service through the bank branch through cheques, or DD or you can make the transfer using the net banking facility in your bank account. There is no minimum limit on the amount that can be transferred.

RTGC: In RTGS the transactions are settled individually and not in batches. The transaction is processed immediately after it is executed throughout the RTGS business hours. The RTGS window is open during official hours. The minimum limit will be varied.

IMPS: It is an instant payment service available for money transfer to bank accounts in India. It is ideal for transactions with a small amount. The main feature of the IMPS service is that it is available 24*7 and on bank holidays throughout the year, which makes it particularly helpful during emergencies. IMPS is used for transfer using the mobile phone number through apps or mobile banking. You can also use IMPS in your net banking services for transfers using account number details. The process is the same as NEFT.

Credit or debit card frauds: Credit card fraud is committed by making use of the credit/debit cards of others for obtaining goods or services. The threats emerge due to stealing information like credit card numbers, PINs, passwords, etc. Theft of cards and cloning of cards are also employed to commit such frauds. Hackers use complex techniques like Phishing, Skimming, etc. to gain credit card information from innocent users.

Research methodology

Research design: For this research uses an exploratory research study because the study aims to discover or find new ideas and insight on this particular topic.

Sample design: The sample for this study was collected by simple random sampling methodology.

Sample size: The Police officers from various police stations of jamtara district of Jharkhand was selected and via proper permission by a senior officer they were interviewed for the purpose that understanding the actual need of investigators & the needy area of investigation in the manner of money flow by the very famous Jamtara district’s cyber offenders.

Source of data: Primary data will be collected by observation method and interview schedule for Police officers of district Jamtara (Jharkhand) and secondary data was collected from various newspapers, e-sources, and the govt. Sites like-NCRB, RBI, ASER, MHRD & various research papers were created as references for our study.

The research tool used: This study, used two types of tools first, the interview schedule was used for police officials & another one was some case study with personal observation.

Digital financial frauds are being within an undefined jurisdiction so it becomes more difficult to investigate the cases and due to other different public as well private sectors of service providers like the telecom companies and the banks are unable to make the defensive system for their customer also.

The advancement of technology has made people much more dependent on the internet and gadgets for all their needs. The Internet has given people easy access to everyone to everything while sitting in one place. The speed of digitalization in our country is so fast and the government of India also promotes digitalization with the digital India scheme and e-governance scheme, with digitalization the threat related to digitalization evolved (Figure 1).

Figure 1: An Image of a cybercafe in a village in Jamtara District of Jharkhand.

To deal with the digital financial fraud technically trained manpower is required but in Jharkhand the condition was poor, it was horrible to note that section 66A of the IT Act is still used to register cases by some police officers of Jharkhand because this section of IT Act was declared unconstitutional by Supreme Court in 2015. This happens because of unawareness & lack of proper training for the police officials.

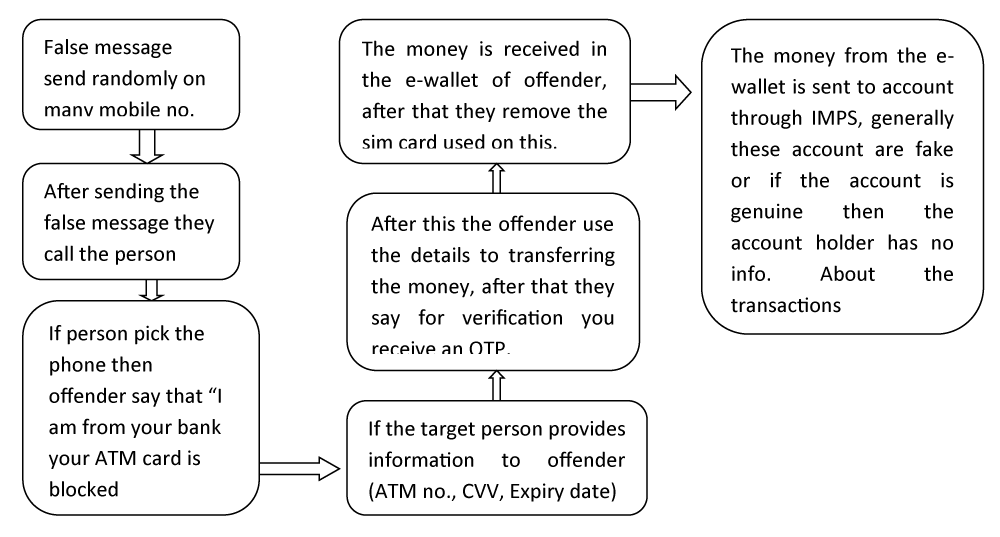

As we know digital frauds are transnational so their jurisdiction is also large & undefined jurisdiction. In our country, policing is a state subject so every state government has its police force and rules & regulations also vary from state to state. So, the police of Jharkhand face lots of inconvenience in investigating interstate Digital fraud (Diagram 1).

Diagram 1: Diagrammatic representation shows the modus of Operandi of the digital fraudster.

To catch accused police of Jharkhand, especially jamtara District police regularly conduct a raid and after the raid, they arrest accused seized various e-device and bank document. These seized articles are sent to a cyber expert or technical cell here police of cybercrime police station face some problems due to a lack of cooperation between the technical cell and cyber police station. Technical cell or forensic labs required at least a few months to provide data. So the trials take some extra time for the cyber forensic lab. Report.

The police also send a request to financial institutions and e-wallet companies to provide relevant information regarding digital financial fraud but there is also a lack of cooperation between financial institution and police which lead to faulty investigation and a low conviction rate in digital financial fraud. The role of the victim in investigation and court proceedings are very important but they generally do not play a supportive role.

Finally, due to the above things the investigation is not done properly and in a good manner which leads to the low conviction rate.

There are some other reasons for low conviction rates including shortage of manpower, lack of stringent law, large jurisdiction, and outdated investigation technology.

Banking security tips for secure banking and safe from digital cyber financial lapses or frauds

• Don’t share any sensitive or personal information related to your finance with anyone:

1. Your details (That is your name, Mobile no., Address, e-mail, etc).

2. Your Banking information (That is Pin, Bank details like- the branch name, account number, etc.).

3. Don’t permit any unauthorized application on your electronic device like – Mobile, Laptop, Palmtop, Tabs, etc.

4. Don’t open any unauthorized attachments or links via any medium:Like: Phone, plain message, social media, E-mails, etc.

5. Don’t share your Cards details with anyone.

Your credit card, debit card, shopping card, etc.

- Current fraud trends in finance sector (2014), PWC

- Digitalindia.gov.in/empowerment

- Upipayments.co.in/aadhaar-enabled-payment-system/

- https://forensicyard.com/jamtara-a-cybercrime-city/

- A Survey Report on the Cyber Crime Growing Vigorously in Jamtara, Jharkhand (India) International Journal of Research in Engineering, Science and Management Volume-1, Issue-12, December-2018.

- Hand book on Prevention of Cyber Crimes and Fraud Management by Indian Institute of Banking and Finance

- Hand book of Digital Banking by Indian Institute of banking and finance.

- https://www.indiatoday.in/magazine/nation/story/20160808-cyber-crime-jamtara-jharkhand-829309-2016-07-27

- https://enewsroom.in/cyber-crime-criminals-jamtara-giridih-jharkhand/

- https://thelawbrigade.com/general-research/cybersecurity-and-cyber-laws-around-the-world-and-india-major-thrust-highlighting-jharkhand-for-concerns/

- https://indianexpress.com/article/india/india-news-india/phishing-in-jamtara-what-does-it-take-to-carry-out-online-fraud/

- https://www.indiatoday.in/india/story/cyber-fraud-new-jamtara-from-financial-frauds-to-phishing-attacks-and-social-media-scams-1767548-2021-02-09

- https://www.hindustantimes.com/india-news/indias-cyber-crime-hub-jamtara-scripting-new-story-with-public-library-mission-101614333756456.html.

- https://archive.factordaily.com/india-winning-war-on-cyber-crime-jamtara/